China as Greece’s Savior: A Threat to Europe?

How the upcoming privatization round in the Eurozone crisis helps China expand its foothold in Europe.

July 16, 2014

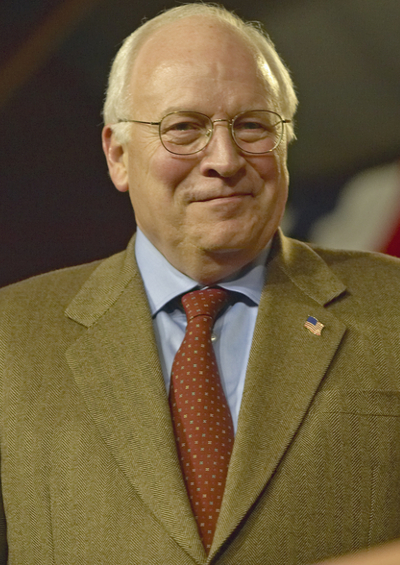

In mid-June 2014, the world press was dominated by headlines from Iraq, Ukraine and the lack of progress in talks between Iran and the 5+1 group. The Chinese media focused on a much narrower theme: the visit of China’s Prime Minister Li Keqiang to Greece.

Athens rolled out the red carpet for Li, in hopes that Chinese investment could put wind in the sails of its economic recovery.

Li’s visit to Greece was the first by a top Chinese official since then-Premier Wen Jiabao visited the country in 2010 at the start of its economic crisis. That was a case of bad timing.

Li’s aim in making the trip was to secure proposed Chinese investment in certain infrastructure projects. Plus, he knows that Greece could serve as an attractive entry point for Chinese investment in the European Union.

On arrival, in China’s standard flowery language, Li said the purpose of his trip was to “expand the relationship between the two great cultures of China and Greece.” Li signed various government-to-government agreements.

China’s targets

But Li’s real purpose was outlined in an article he penned for the Greek daily Kathimerini, which appeared the day before he arrived.

“We will work together with Greece to turn the port of Piraeus into the best of its kind in the Mediterranean,” he wrote.

“China seeks closer cooperation with Greece over airports, railroads, road networks and other infrastructure. Greece is speeding up privatizations and infrastructure development. China will encourage its acclaimed businesses to play an active role in the process,” he concluded.

Li traveled to Crete, where the Tybaki port and the airport of Kasteli will soon be privatized. They are considered potential investment targets for China.

A dozen ports, including Pireaus and the one at Thessaloniki, are to be privatized under a state asset sales program mandated under the country’s EU-IMF debt rescue.

China’s Fosun Group got China off to a great start in the competition for Greek infrastructure development earlier this year, when it was selected to lead a €6 billion redevelopment of Athens’s old Ellinikon airport into a housing and leisure complex.

The closeness of the relationship and the importance that China attaches to it was underscored in mid-July by Chinese President Xi Jinping’s visit to Greece — a stopover on the Greek island of Rhodes as he was on his way to Latin America for a BRICS summit meeting.

Gunning for the big prize

The big prize is the government’s 67% stake in Pireaus. The Chinese shipping company COSCO is considered the favorite to win the deal due its prior success in gaining the 35-year concession to expand the port’s two main container terminals.

But this isn’t all future stuff. Few people realize that Greek shipowners are the biggest clients of China’s shipbuilders.

The Greek shipping sector accounts for about 7% of Greece’s GDP and employs about 192,000 people. The Greek shipping sector accounts for more than 16% of the global fleet and almost half the tonnage of all European vessels. In total, Greek shipowners have 3,669 ocean-going ships over 1,000 gross tons.

The reason why Li spent a lot of time hobnobbing with prominent Greek shipowners during his visit was not because the companies are for sale, which they are not.

Rather, it was because Chinese shipyards are the main beneficiaries of a building drive by Greek shipowners to add new ships to their fleets.

At present, Chinese shipyards — the biggest in the world by tonnage — have 192 orders for new ships from the Greeks. South Korea follows with 162 new orders for hulls and Japan with 27.

Li made it clear in his meetings with Greek shipowners that it is good for both countries to develop the industry together and to get more efficient.

China’s systematic approach

When Wen Jiabao visited Greece in 2010, he was there to explore investment opportunities. But over the next four years, as the financial crisis took hold of the eurozone, China made very few investments.

Wen hinted that China would help bail the eurozone out. But this aid from China was conditional on the EU agreeing to ease trade rules with China and to end the ban, put in place in the wake of the Tiananmen Square massacre in 1989, on selling China arms and defense systems.

The EU eased trade rules somewhat, but not enough for China’s purposes.

Li arrived in Greece at just the right time. At least two years behind schedule, Greece is finally being forced to privatize many of its state-owned operations. They run the gamut from amusement parks and hotels to railroads, roads, airports and, of course, shipping ports.

In short, Greece has a great deal of targets for Chinese investments. And Athens is desperate for cash, of which China has plenty.

We expect to see China strike many deals to buy Greek government stakes in roads, rails, airports and ports. COSCO seems a cinch to win control of Piraeus, which from a geopolitical and strategic point of view, should trouble Brussels.

The question is whether anybody in Brussels will even notice, distracted as Europe is by events in Ukraine and in Iraq among many other crises, including the EU’s continuing lackluster economic performance.

Takeaways

Why is China interested in Greece? As an attractive entry point for Chinese investment in the EU.

Greece’s economy is weak, which means Chinese companies, flush with cash, hold a lot of strong cards.

China’s interest in Greece is focused on a truly strategic asset – control over the port of Piraeus.

China has a systematic approach to foreign commerce. Its officials regularly visit countries, to soften them up.

How the upcoming privatization round in the Eurozone crisis helps China expand its foothold in Europe.