Cryptocurrencies Soar, Governments Lose

The rise of cryptocurrencies reflects the public’s loss of trust in governments and the global financial system.

January 13, 2024

A Strategic Intervention Paper (SIP) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Intervention Paper (SIP) published by the Global Ideas Center in Berlin on The Globalist.

The staggering rise in the value of Bitcoin and all other cryptocurrencies reflects the sharp demise in public support for the governments of the world’s leading economies and the global financial system that they control.

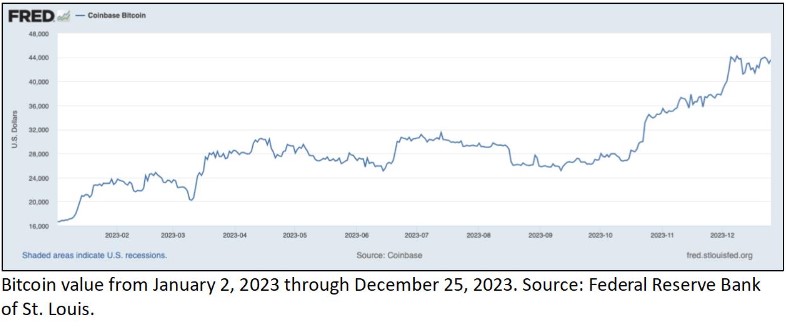

At the start of 2023, the Bitcoin price-per-unit was around $17,000. By the end of the year, it exceeded $42,000. And, in the first 10 days of 2024, it peaked at $48,000.

No end in sight?

It may continue to soar to even higher levels now that the U.S. Securities and Exchange Commission stated on January 10 that it:

“Approved the listing and trading of a number of spot Bitcoin exchange-traded product (ETP) shares” on stock exchanges. Brokerage companies and investment firms can offer shares to the public whose value is related to a totally artificial “currency.”

Recent years have seen media commentators attribute the rise of cryptocurrencies to a hedge against rising inflation, the libertarian whims of Elon Musk and the mounting distrust in the United States’ political future and that of the dollar following the January 6, 2020, mass violent protests in Washington in support of Donald Trump.

Bitcoin may reflect the United States’ decline, suggested Financial Times columnist Rana Foroohar in February 2021.

A symptom, not the cause

I believe the prime driver of crypto’s value surge is even broader. There is a wide fear by increasing numbers of people in many parts of the world that governments are more unpredictable than ever.

They fear that security is at great risk, and that the system of global finance – including government controlled financial institutions, (such as central banks), and publicly listed and officially regulated private financial institutions (such as most stock exchanges and banks) – serve tiny powerful elites at the expense of the middle-classes.

Compounding the rise of Bitcoin, according to a large Wall Street investor whom I met with in New York, is the prospect of the United States and the European Union agreeing to seize $300 billion of Russian funds, and to use them for Ukraine reconstruction which is shaking the faith in major currencies by many central banks outside of Europe and North America.

“Bitcoin protects them from such asset seizures,” he asserted.

An invisible currency

A Bitcoin is not a coin. It is not something you can hold, or even see. It is a computer-generated number that is backed, unlike most official currencies, by absolutely nothing.

No entity of any kind vouches for the value of this invisible so-called currency, or even its safe management. Cryptocurrencies are mostly traded on exchanges unsupervised by official financial regulatory authorities.

To buy and hold cryptocurrencies is to gamble. There are no fundamental indicators to influence judgement, as there are when acquiring publicly listed stocks and bonds.

The SEC on approving listing of shares related to Bitcoin’s value was clear that it was not endorsing the whole medium of cryptocurrencies – even though investors will unquestionably see the SEC action as a seal of approval.

The crypto-gamble is far more risky than betting in the glitzy halls of Las Vegas hotels where security systems operate to curtail cheating of any kind. The crypto-world is rampant with gangsters, yet demand continues to surge – so powerful is the desire by so many to speculate in units of supposed-value, which are free of any publicly official control.

Criminal managers

The cryptocurrency market is driven by retail speculators who pour their savings into the hands of exchanges that they know nothing about. The speculators seem oblivious to the criminals running – or, who used to run – some of the leading crypto-exchanges.

On November 2, 2023, a New York jury found Samuel Bankman-Fried guilty of multiple crimes of fraud. The charges that were brought against him, according to the official U.S. Department of Justice complaint included:

“Conspiracy to commit wire fraud, wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to defraud the Federal Election Commission and commit campaign finance violations. The charges in the Indictment arise from an alleged wide-ranging scheme by the defendant to misappropriate billions of dollars of customer funds deposited with FTX, the international cryptocurrency exchange founded by the defendant, and mislead investors and lenders to FTX and to Alameda Research, the cryptocurrency hedge fund also founded by the defendant.”

Also in November 2023, Binance Holdings Limited, the world’s largest crypto-exchange, pleaded guilty to multiple crimes, including money-laundering, and agreed to pay a fine of US$ 4.3 billion.

The Justice Department also stated that Changpeng Zhao, Binance’s founder and Chief Executive Officer, “pleaded guilty to failing to maintain an effective anti-money laundering (AML) program.”

Both Bankman-Fried and Zhao are now awaiting sentencing. FTX is being liquidated. Binance continues – although the company refuses to publicly disclose where it is headquartered.

North Korean military “hackers”

Cryptocurrencies are the medium of exchange that attracts international criminal networks. The ability to secure anonymity in global financial transactions of a multi-nation type has been part of the routine operations of North Korean “hackers” who have stolen vast sums from major Western corporations and laundered their cash through the hidden channels of the crypto-world.

So, for example, U.S. authorities charged Jon Chang Hyok, Kim Il and Park Jin Hyok as “members of units of the Reconnaissance General Bureau (RGB), a military intelligence agency of the Democratic People’s Republic of Korea (DPRK), which engaged in criminal hacking.”

The multiple charges brought against them in 2021 included:

“Targeting of hundreds of cryptocurrency companies and the theft of tens of millions of dollars’ worth of cryptocurrency, including $75 million from a Slovenian cryptocurrency company in December 2017, the theft of $24.9 million from an Indonesian cryptocurrency company in September 2018 and $11.8 million from a financial services company in New York in August 2020 in which the hackers used the malicious CryptoNeuro Trader application as a backdoor.”

Cryptocurrencies are not just a means for the North Korean military to steal and hide cash, but also a pathway to illicit riches for terrorist organizations.

For example, in 2020, the U.S. Justice Department uncovered and, to use its word, “disrupted,” the largest ever terrorist financing scheme involving cryptocurrencies. Vast schemes designed to fund the activities of the al-Qassam Brigades, Hamas’s military wing, al-Qaeda and the Islamic State of Iraq and the Levant (ISIS).

The investigation discovered over 150 separate crypto accounts that were used to finance Hamas.

Moscow connections

U.S. government investigations have included the operations of Garantex, which The Wall Street Journal reported “is by far the most popular crypto exchange in Russia for ruble trading.”

In a story by Journal reporter Angus Berwick in October, 2023, Garantex is being used to assist Russian banks and oligarchs to evade sanctions imposed by the West after Russia launched its invasion of Ukraine. At the same time, according to the report, Garantex has been a large facilitator of funds to Hamas.

The United States has sanctioned Garantex, but its activities continue nevertheless. The company, originally registered in 2019 in Estonia, operates out of Moscow and St. Petersburgh and at the time the United States sanctioned it in April 2022, the Treasury stated: “Analysis of known Garantex transactions shows that over $100 million in transactions are associated with illicit actors and darknet markets.”

In fact, crime related to cryptocurrencies is expanding rapidly, according to U.S. authorities. In a 2022 report, the U.S. Justice Department defined three major areas of criminality:

1. Cryptocurrency as a means of payment for, or manner of facilitating, criminal activity

2. The use of digital assets as a means of concealing illicit financial activity

3. Crimes involving or affecting the digital assets ecosystem.

However, as the digital financial world becomes more sophisticated, with increasing numbers of players and investors and the adaption of ever-newer technologies, so efforts by Western governments to investigate and regulate become ever-more challenging. Hence, over time, cryptocurrencies may emerge as the prime mechanism for money laundering across the world.

Efforts to regulate

The cryptocurrency universe serves no productive and constructive purpose. As it grows, so professional traders in the finance industry dive in and out of it to speculate and take profits and help the growth of the market and some even voice opposition to any form of government regulation.

U.S. Senator Elizabeth Warren is leading the charge in the U.S. Congress for tough regulation of crypto-finance. She has strong support from Jamie Dimon, Chairman and Chief Executive Officer of the United States’ largest bank, JP Morgan Chase, who has said repeatedly that the whole crypto-market should be “shut down.”

Noting the increasing number of reports of the criminal uses of cryptocurrencies from the U.S. Treasury and the Justice Department, Warren argues that, “We need new laws to crack down on crypto’s use in enabling terrorist groups, rogue nations, drug lords, ransomware gangs and fraudsters to launder billions in stolen funds, evade sanctions, fund illegal weapons programs and profit from devastating cyberattacks.”

Public fear and speculation

While Warren is gathering supporters in Congress, the hard fact is that the crypto-markets are expanding, with exchanges being based across the globe and structured in many cases to evade U.S. sanctions and regulations.

Warren’s legislation may, at the margins, have a beneficial impact as may U.S. Justice Department investigations of the major trading exchanges. However, the hard fact is that the demand for cryptocurrencies is being driven primarily by retail investors who combine the nerves to take big risks and gamble – with a core aversion to every aspect of established, traditional finance.

Some Wall Street financial firms are lobbying hard against new regulations and they will jump on the landmark SEC approval of January 10 to bolster their case.

The crypto-game is bigger than the money launderers, “hackers,” oligarchs, organized criminal networks and professional traders. It reflects the failure of confidence by tens of thousands of people, maybe millions.

Binance declares on its website that over 170 million “users trust us.” But we have no idea of just how many participants there are in these shady markets – in the dollar, the yen, the euro, the pound, the Swiss franc, and the Chinese reminbi, and the central banks that stand behind these currencies and the governments that stand behind these central banks.

How low is trust in government today? It plummets as reflected in the rising course of crypto – just look at the Bitcoin chart.

Takeaways

The rise of cryptocurrencies reflects the public's loss of trust in governments and the global financial system they represent.

Recent years have seen media commentators attribute the rise of cryptocurrencies to a hedge against rising inflation, the libertarian whims of Elon Musk and the mounting distrust in the United States.

The prime driver of crypto’s value surge is the fear in many parts of the world that governments are more unpredictable than ever, and that the system of global finance serves only powerful elites.

As the digital financial world becomes more sophisticated, with increasing numbers of players and investors and the adaption of ever-newer technologies, so efforts by Western governments to investigate and regulate become ever-more challenging.

The cryptocurrency universe serves no productive and constructive purpose. As it grows, so professional traders in the finance industry dive in and out of it to speculate and take profits.

The crypto-game is bigger than the money launderers, “hackers,” oligarchs, organized criminal networks and professional traders. It reflects the failure of confidence by tens of thousands of people, maybe millions.

A Strategic Intervention Paper (SIP) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Intervention Paper (SIP) published by the Global Ideas Center in Berlin on The Globalist.

Read previous

Global Diary

Paperless China?

January 7, 2024