Greece: A Vote for Stability, Growth and Reforms

A second term for Kyriakos Mitsotakis is not just good news for Greece. It also sends important signals to Europe.

June 28, 2023

A Strategic Assessment Memo (SAM) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Assessment Memo (SAM) published by the Global Ideas Center in Berlin on The Globalist.

In a repeat election, Greece’s conservative New Democracy party, led by the economic reformer Kyriakos Mitsotakis, won an impressive 40.6% of the popular vote. Under a system that awards bonus seats to the strongest party, Mitsotakis now has a majority of 158 out of 300 seats in the Greek parliament.

Important signals to Europe

This is not just good news for Greece. It also sends two signals to Europe. First, the political extremes can be pushed back. Voters are ready to reward policy makers who take the sometimes unpopular decisions to advance their economies.

Second, the erstwhile crisis economies of the Eurozone periphery can be turned by suitable reforms into a source of growth and stability for Europe.

Greece: A star performer

The Mitsotakis government has transformed Greece into the star performer among the major euro members. Like Germany with its 2003-2005 reforms, Greece has shown that being a member of the euro can encourage a country to reform its supply side rather than hoping for a potentially inflationary central bank financing of fiscal deficits.

Since Mitsotakis took office in mid-2019, Greek investment (gross fixed capital formation) has surged by 42% in real terms as domestic and foreign businesses responded to his pro-growth agenda.

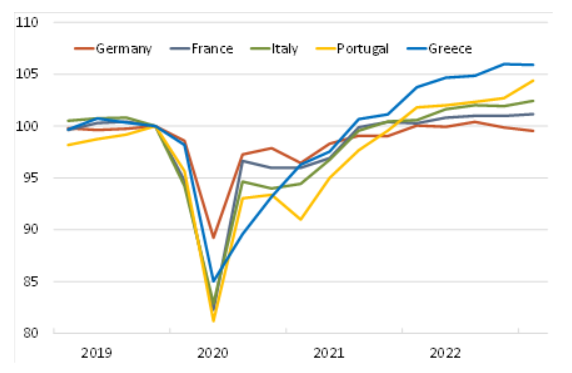

As a result, Greek GDP surpassed its pre-pandemic level by 5.9% in the first quarter of 2023 – far ahead of the 2.2% gain for the Eurozone as a whole. The surge in Greek exports from a mere 19% of GDP in 2009 to 47.5% in early 2023 reflects the country’s stronger competitive position.

Coming soon: A lower debt level than Italy

From a peak of 206% in 2020, the ratio of Greek public debt to its GDP has fallen to 171% by the end of 2022.

Greece looks set to decline below Italy’s debt ratio (144% of GDP) by 2026, helped by generous long-term financing from Greece’s official creditors. As a result, Greece should be on track to regain an investment-grade rating for its govern¬ment bonds soon.

Remember the so-called euro crisis?

This is a rather stunning turnaround from the times when Greece lost access to debt markets in early 2010 and the country’s GDP plunged by a total of 23% in the five years to end-2014.

At the time, an excessive emphasis on front-loaded austerity, which Greece agreed with its official creditors in return for major aid packages, exacerbated the slump. It would have been much better if the parties had instead agreed on faster pro-growth reforms back then.

But in the end, Greece has shown that being a member of the euro can encourage a country to reform its supply side – rather than hoping for a potentially inflationary central bank financing of fiscal deficits.

Tsipras’s losing vision for Greece

Mitsotakis promises more of his pro-growth policies, combined with a strong social element. In the last two years, he has started to use the fiscal space that Greece has gained due to buoyant tax receipts to lift social spending and reduce the tax burden.

The success of Mitsotakis has taken a toll on the political fortunes of former Prime Minister Alexis Tsipras and his Syriza Party. Although Tsipras has mellowed since his hard collision with markets in 2015, his leftist manifesto still called for a reversal of some key labour market reforms, including reduced working hours. He also pushed for the nationalization of a major bank and Greece’s key utilities.

Voters were not impressed – and Syriza was soundly beaten, even losing its status as the second-strongest party in Greek politics. As a result, the days of Mr. Tsipras leading his party may be numbered.

Advantage Greece: real GDP

Real GDP, Q4 2019 = 100. Quarterly data. Source: Eurostat

Takeaways

Greece’s latest election shows that the political extremes can be pushed back. Voters are ready to reward policy makers who take the sometimes unpopular decisions to advance their national economies.

Greece’s development shows that the erstwhile crisis economies of the Eurozone‘s “periphery“ can be turned by suitable reforms into a source of growth and stability for Europe.

Greece looks set to decline below Italy’s debt ratio (144% of GDP) by 2026. From a peak of 206% in 2020, the ratio of Greek public debt to its GDP has already fallen to 171% by the end of 2022.

Greek GDP surpassed its pre-pandemic level by 5.9% in the first quarter of 2023 – far ahead of the 2.2% gain for the Eurozone as a whole.

Greece has shown that being a member of the euro can encourage a country to reform its supply side – rather than hoping for a potentially inflationary central bank financing of fiscal deficits.

A Strategic Assessment Memo (SAM) from the Global Ideas Center

You may quote from this text, provided you mention the name of the author and reference it as a new Strategic Assessment Memo (SAM) published by the Global Ideas Center in Berlin on The Globalist.

Read previous

Global Conflict

End of the Ukraine War?

June 26, 2023