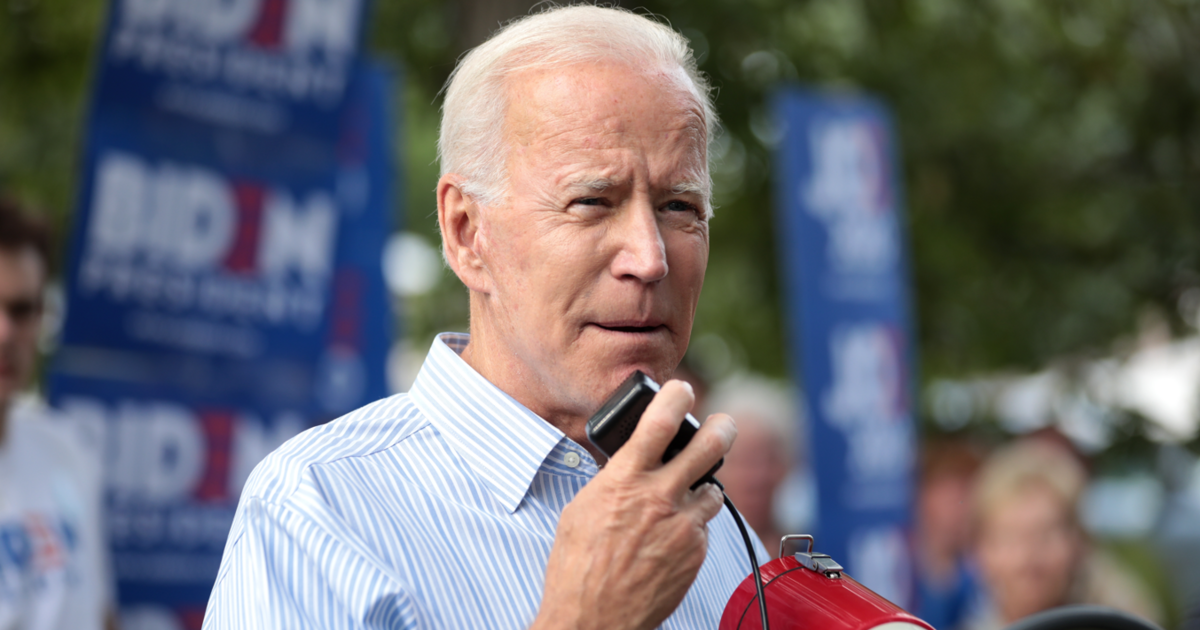

Is Joe Biden A “Socialist”? Not With These Tax Plans

Despite Trump’s assertions, Biden’s tax plans are far removed from “radical socialism.”

September 22, 2020

President Donald Trump loves to thunder that Joe Biden is a “socialist,” a puppet of the “radical left.”

But Biden’s tax proposals are generally moderate and pragmatic. They represent a necessary correction to Trump’s massive and excessive tax cuts for corporations and ultra-rich Americans.

Capitalism will remain alive and well, if Biden becomes President, and his spending plans could invigorate the U.S. economy. They won’t be installing a statue of Karl Marx in a Biden White House.

You won’t see any fingerprints of Bernie Sanders or Alexandria Ocasio-Cortes on Biden’s tax proposals. There is no wealth tax. Nor are there confiscatory, 70%-plus rates on incomes above $10 million, as AOC proposed.

The top 1% of Americans would do just fine under a Biden administration. And although corporate tax rates would rise, they would still be lower than they were during the Obama Administration. That’s hardly the stuff of revolution.

Wise spending

Furthermore, Biden would use the additional tax revenues to fund crucial, long overdue investments in infrastructure, education and housing. Some measures could benefit the U.S. economy on a long-term basis, while others tackle important social issues.

Trump’s tax cuts pumped up the stock market for a year. But despite a lot of hype, they did nothing to increase capital investment or stimulate the real economy.

Instead, the cuts blew a hole in the government’s finances. They are the main reason the annual deficit jumped 80% to $1.1 trillion on Trump’s watch—and that’s before the impact of COVID 19.

Taxes would Rise…but only for the top 1.5%

Biden would not change personal income tax rates for Americans who earn less than $400,000. Their taxes might rise slightly because of indirect effects related to his proposed increase in the corporate tax rate. Still, that means only the top 1.5% of Americans would notice much of a change.

The top 1%–those with incomes above $700,000—might see their effective tax rate increase about 4 points, to roughly 38%.

So their after-tax income might decline by 8.5%. That’s based on projections from the Penn Wharton Budget Model group at the University of Pennsylvania, which takes a non-partisan approach in evaluating such proposals.

The top 0.1% of Americans would take a major hit. They would bear over 50% of Biden’s tax increases, and their after-tax income might drop 18%, according to Penn Wharton. But it’s a pretty exclusive club: you have to have an income of over $3 million a year.

That’s the same group, of course, which received a huge windfall from the Trump tax cuts. Biden would essentially reverse those, and he would also increase the tax rate on capital gains. The effective tax rate for the top 0.1%’s of Americans could jump from 34.6% to 43% in the first year of Biden’s tax program, Penn Wharton estimates.

Many members of the top 0.1%, aside from high-minded types like Warren Buffett and Bill Gates, may decide to vote for their pocketbook and support Trump. But they should realize that the 2017 tax cuts were fiscally irresponsible and not sustainable.

The ultra-rich should also think hard about the benefits of living in a democracy and under a competent government, rather than being ruled by corrupt, bumbling autocrats. Some things in life are priceless.

Corporate taxes would still be reasonable

Biden would increase corporate tax rates to 28%, up from 21%. That change would crimp companies’ profits somewhat, but bear in mind that the federal corporate tax rate was 35% before the Trump tax cuts.

That was too high relative to tax regimes in other countries. But a 28% levy is a reasonable compromise that would allow U.S. firms to remain competitive on a global level. This change would be Biden’s largest single tax increase, and it would help to trim the government’s structural budget gap.

Some industries would lose special tax breaks

Private equity firms would pay regular tax rates on profits on their investments, rather than the ridiculously low 20% based on the so-called “carried interest” loophole. Real estate investors would incur taxes when they sold properties. Under current law, they can defer taxes by exchanging “like” properties…repeatedly.

You can understand why Donald Trump might consider that last proposal “socialist”. The President has bragged that he has not paid taxes for many years.

The big hit: Capital gains

Biden has proposed several tax increases for individuals with incomes over $400,000:

• Restoring the top tax rate on ordinary income above that amount, from 37% to 39.6% (the rate before the Trump tax cuts)

• Applying the Social Security payroll tax on income above that amount

• Limiting tax deductions to 28% of their value

But Americans living in high-tax (and Democratic) states like New York or California might get some offset to these increases.

Biden has not talked about removing the $10,000 cap on deductions for state and local taxes, which the Trump tax code revisions imposed for the first time ever, in a punitive move aimed at Blue states.

However, the Democratic majority in the House has already proposed restoring those deductions, in one of the pandemic relief bills. (The Senate rejected that provision.) Passage of such legislation will depend on the outcome of the elections, of course.

One of Biden’s proposals is novel: he would double the rate on capital gains to 39.6% from 20%, by taxing such gains as ordinary income. But—and it’s an important but—this provision would apply only to taxpayers with incomes above $1 million.

That’s less than 1% of Americans. And unlike some progressive Democrats’s proposals, Biden would impose the higher tax rate only on realized capital gains.

Gearing up to compete with China

In another sharp contrast with some progressives, Biden’s aim is not to impose higher taxes to punish the rich or redistribute wealth, Biden would use the money to fund most of the costs for new spending programs.

Unlike Trump, Biden’s plans would not cause a massive spike in the deficit. Some investments could improve the U.S. economy’s relative competitiveness, and others would address important social problems.

Biden has proposed to invest in four key areas over the next 10 years:

• Education-$1.9 trillion

• Infrastructure and research and development-$1.6 trillion

• Housing-$650 billion

• Healthcare—a net $352 billion

Massive investments

Biden’s education program includes universal pre-K, two years of free college for all students, and free public college for low-income students. The former Vice President would invest in water infrastructure, high-speed rail, green infrastructure and clean-energy projects, as well as artificial intelligence.

The overarching goals would be a better-educated workforce and an economy more equipped to compete with China and other nations. The infrastructure and energy projects should generate a lot of jobs, too.

The former Vice President’s programs would also seek to alleviate severe shortages in public and affordable housing. As for health care, Biden won the Democratic Primary partly because he refused to back Bernie Sanders’ sweeping Medicare for All proposal.

Biden prefers to follow an incremental approach, which is based on expanding the reach of the Affordable Care Act and has a much lower price tag. Biden would reduce the cost of medical insurance under the Affordable Care Act and lower the Medicare eligibility age from 65 to 60 years.

To paraphrase Joe Biden, “Do these proposals look like radical socialism to you?”

Takeaways

Donald Trump likes to label Joe Biden as a “socialist.” Biden’s tax plans say otherwise.

The top 1% of Americans would do fine under a Biden administration. Though corporate tax rates would rise, they would still be lower than during the Obama Administration.

Biden’s tax proposals are moderate and pragmatic. They represent a necessary correction to Trump’s massive tax cuts for corporations and ultra-rich Americans.

Biden’s aim is not to impose higher taxes to punish the rich or redistribute wealth. He would use the money to fund most of the costs for new spending programs.

Unlike Trump’s tax plan, Biden’s plans would not cause a massive spike in the US deficit.